Table of Contents

Diving into the world of lithium and how it plays out on the ASX? Well, you’ve hit on a goldmine, or should I say, lithium mine of potential as we will tell you exactly which shares to buy now. With the electric vehicle (EV) market charging up, lithium is becoming more precious than ever. And guess what? Australia is at the forefront of this revolution.

The Lithium Demand Surge

So, here’s the scoop: lithium demand is zooming, expected to skyrocket by 20% annually. Tesla alone is eyeing around 1,000 kilotons of lithium carbonate equivalent (LCE) by 2030. That’s a whopping 16 times what they needed in 2022 and a third more than the whole world’s current production.

It’s not just about the cars though; every battery-powered gadget joining the green revolution is crying out for lithium.

Australia? It’s sitting on a lithium goldmine, being the largest spodumene (that’s lithium ore to you and me) producer on the planet and holding the second-largest lithium reserves. But here’s the kicker – while we’re good at digging it up, we’re just starting to turn it into the high-grade lithium hydroxide that batteries love. This shift is where the magic happens, which can potentially add a cool $10 billion a year by 2030 to the market.

Australia’s Refining Game

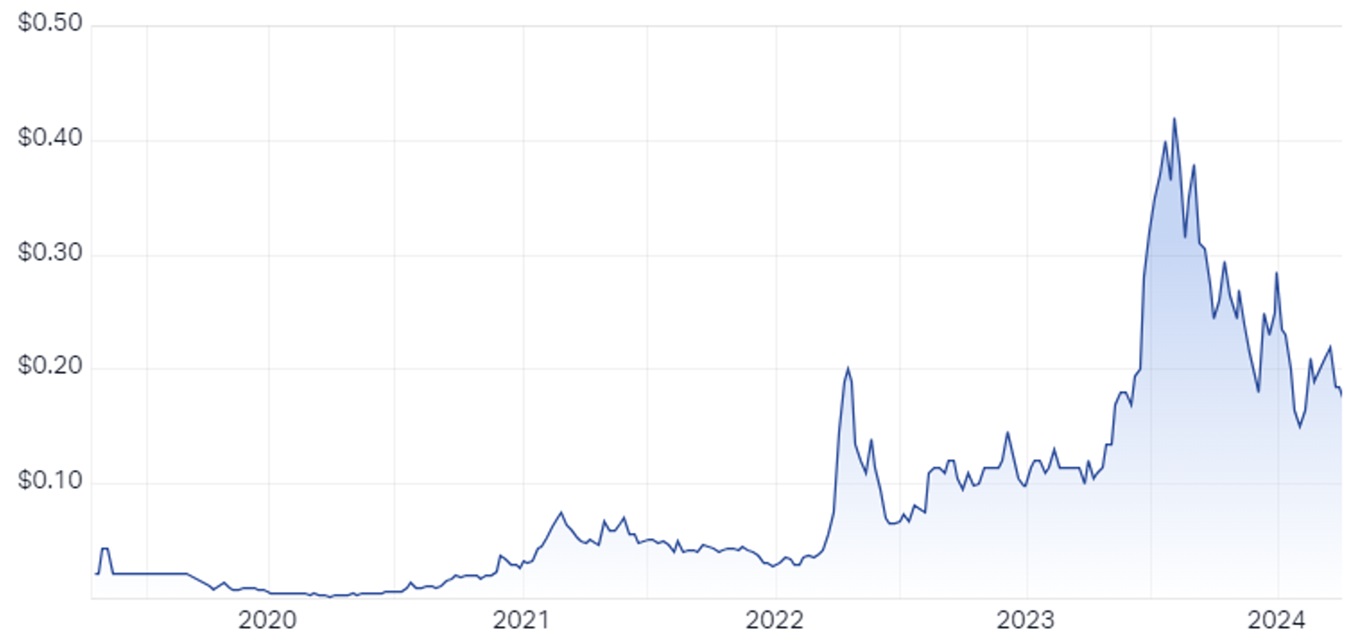

Now, with the lithium spot price doing a bit of a dance – hitting all-time highs before settling down again – the stage is set for Australia to ramp up and refine our game. The current setup has got us shipping most of our lithium to China for processing. But with new projects kicking off, Australia’s looking to cut a larger slice of the lithium pie by refining it ourselves, boosting profits, jobs, and our standing in the green energy push.

Why’s this a big deal? Well, lithium hydroxide is the secret sauce in those high-nickel NMC batteries that are setting the EV world on fire, offering better performance. Demand for this refined product is expected to outpace the more traditional lithium carbonate, setting the stage for Australia to turn its natural resources into an even bigger competitive edge.

Seizing The Opportunity

This isn’t just about digging up and shipping out. Australia is looking at a golden opportunity to lead in a rapidly evolving market. The trick? We need to start refining more of our lithium at home, tapping into the burgeoning demand for cleaner, more efficient battery power.

Think of it this way: the world’s EV market is like a hungry beast, and lithium is the feed. Australia’s got the feed in spades, but now we’ve got to cook it upright to reap the benefits. This means jumping hurdles – from ramping up refining capacity to handling the challenges of a tight labour market and capital-intensive setups.

In essence, stepping up our lithium game could be a win-win, fueling the EV revolution while powering Australia’s economy forward. And for those of us eyeing the ASX, this sector’s where the action’s at. It’s a dynamic space, with every twist in the lithium tale potentially sparking movements in stock prices and investor interest.

So, as we dive into discussing the top 5 ASX lithium stocks, remember, we’re not just talking numbers and charts. We’re looking at a sector at the heart of the green energy transition, with Australia poised to play a pivotal role. Ready to explore how this plays out in the market? Let’s get charged up and dive in!

Top 5 Lithium Stocks ASX

Explore the Leading 5 lithium stocks asx for Strategic Investment Opportunities.

Pilbara Minerals

Alright, diving into Pilbara Minerals, here’s the deal: this stock is on the frontline of the lithium revolution, a core component of the EV market that’s only going to expand. Despite recent price dips, Pilbara’s expanding production — targeting a massive 70% increase with its P680 and P1000 projects — sets it up for significant growth. They’re not just digging up lithium; they’re building strategic partnerships with heavyweight battery companies like Ganfeng and Chengxin, linking arms with industry giants Tesla, BMW, and more.

This isn’t just about now; it’s about catching the wave of future demand, which, with EV projections skyrocketing, looks pretty sunny. Plus, their proactive sales strategy diversifies risk. Sure, UBS throws in a cautious tale, but remember, market dynamics are a pendulum. With Pilbara’s ambitious expansions and strategic moves, betting on them could be your ticket to riding the green energy wave. Think long-term, mate; Pilbara’s setting up to be a key player in a future where batteries power the world.

Latin Resources

Latin Resources’ exploration projects into Maverick Minerals, is aiming for a tidy $5 million raise at 20 cents a pop. This move sharpens focus and values Maverick at $8.6 million at the jump, with Latin Resources holding a solid 16% stake. Plus, their projects sprawl from Western Australia to Canada, covering some prime lithium territory.

Now, lithium prices have been on a rollercoaster, sure, but Latin Resources boasts a lower cost base around US$540/ton, compared to others sweating over higher costs. This leaner cost structure puts them in a stronger position to weather the lithium market’s ups and downs. And let’s not forget, they’ve bumped their Colina Deposit Mineral Resource Estimate by a hefty 41%, signaling solid growth potential at their Salinas Project in Brazil. Worth considering, don’t you think?

Allkem

Have you caught the buzz around Allkem merging with Livent to form Arcadium Lithium? This mega-deal, closing at $14.3 billion, is shaping up to be a game-changer in the lithium market. They are holding keys to some of the most promising lithium mines across the globe, from the hard-rock beauties in Western Australia to the brine treasures in Argentina. And they’re not stopping there, eyeing a whopping 250,000 tonnes per year of lithium production by 2027.

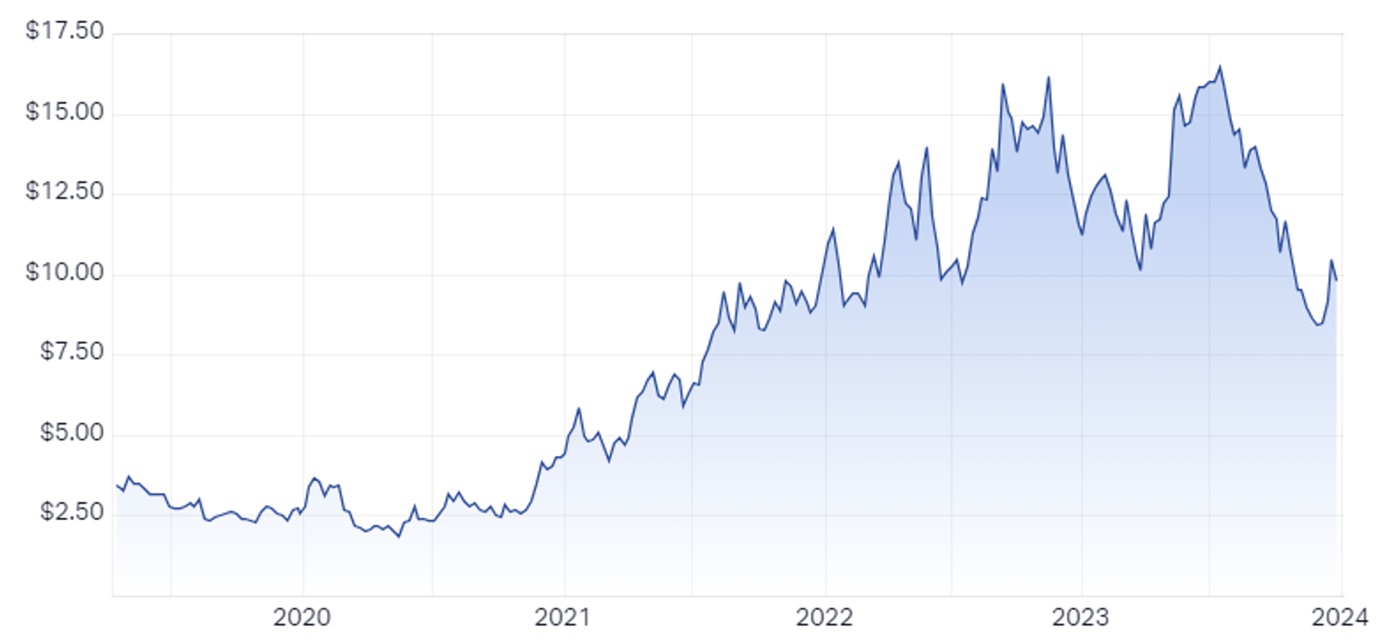

Yeah, I know, Allkem’s share price has been on a rollercoaster, hitting a new 52-week low recently. It seems like the whole lithium sector’s been under the weather, with prices dipping and the market adjusting. But here’s the kicker: downturns like these can be the perfect time for investors. With Allkem beefing up production and diving into new projects, this dip might just be a blip on the radar. Could be a golden ticket to hop on board before this train leaves the station.

Leo Lithium

They’ve just beefed up their partnership in the Goulamina Lithium Project – we’re talking a $65 million deal that hikes Ganfeng’s stake to a solid 60%. This is a huge nod of confidence from China’s top lithium producer in Leo’s potential to hit the big leagues.

They’re deep into talks with the Mali government to smooth out the path ahead, aiming to transform Goulamina into a lithium powerhouse. Simon Hay is all pumped, saying this partnership with Ganfeng is a major thumbs-up for the project’s world-class prospects. Plus, they’ve got the construction moving along nicely.

The cash from this deal is set to cover Leo’s short-term needs, especially with some settlement payments to the Mali government on the horizon. They’re doing this in two parts, ensuring they stay on good footing with the government.

So, why should you consider Leo? It’s not just about the cash injection. It’s about backing a team that’s clinched a vote of confidence from one of the lithium industry’s giants, signalling Goulamina’s potential to skyrocket.

Azure Minerals

Let me tell you, it’s getting pretty exciting. They’re at the centre of a bit of a tug-of-war between some big names – think Mineral Resources and Gina Rinehart’s Hancock Prospecting. These heavy hitters are all over Azure’s Andover lithium project in Western Australia. And why wouldn’t they be? With lithium’s role in the battery world, everyone’s looking for a piece of the action.

Now, Azure’s share price has gone through the roof, skyrocketing almost 1,600% this year alone. Insane, right? But here’s where it gets interesting. The FIRB just pushed the approval deadline for a major buyout offer from April 10 to April 30. SQM and Hancock Prospecting are lining up to take a significant stake, and with SQM being a global lithium giant, that’s no small beer.

So, why consider jumping in? Beyond the buzz and the big names circling, the long-term outlook for lithium is bright. Demand’s only going up, and Azure’s sitting on some prime lithium soil that could see prices and interest soar. Plus, being in the mix with companies that have deep pockets and big ambitions could mean Azure’s poised for some exciting developments.

Conclusion

So, wrapping this up, let’s just say the ASX lithium scene is crackling with energy right now, all thanks to this global rush for electric vehicles and cleaner energy sources.

Each of these companies is carving out its growth path. It’s all about teaming up with the right companies, rolling out some cool projects, and staying nimble in this ever-changing market. These top 5 picks? They’re not just part of the race; they’re leading the charge towards a future powered by green energy.

If you’re keen on the idea of investing in a cleaner, greener future, then these lithium leaders on the ASX are where you might want to look. Who knows, diving into this now could be one of those moves we look back on and think, “Yeah, we were part of that change.”

No Comments